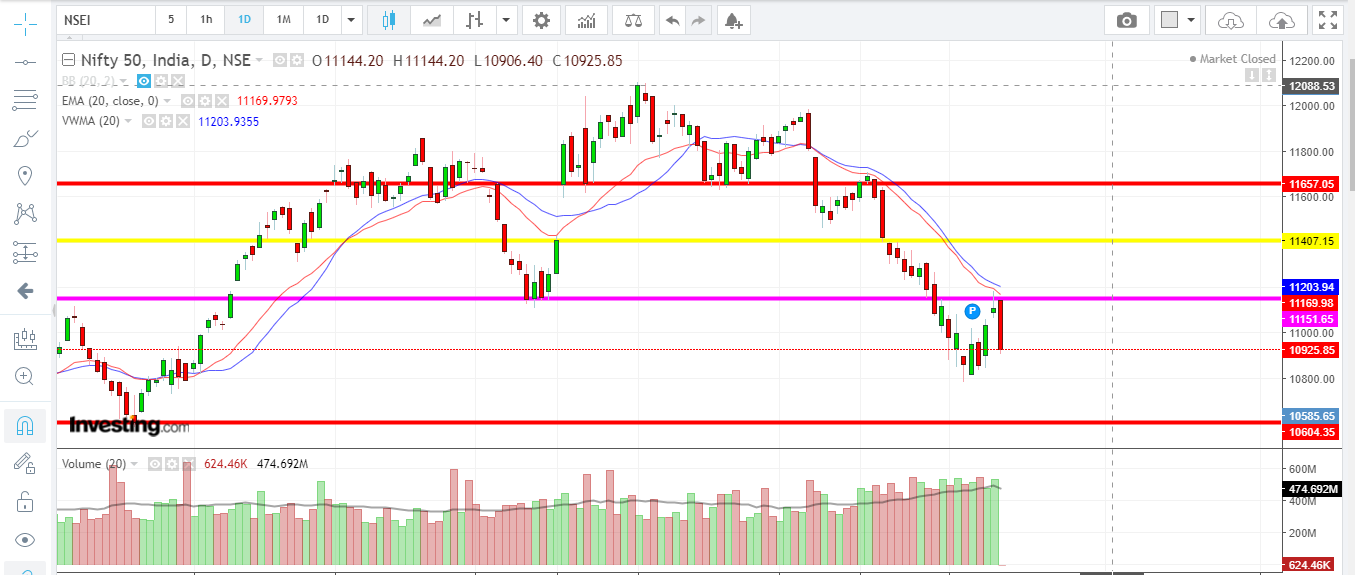

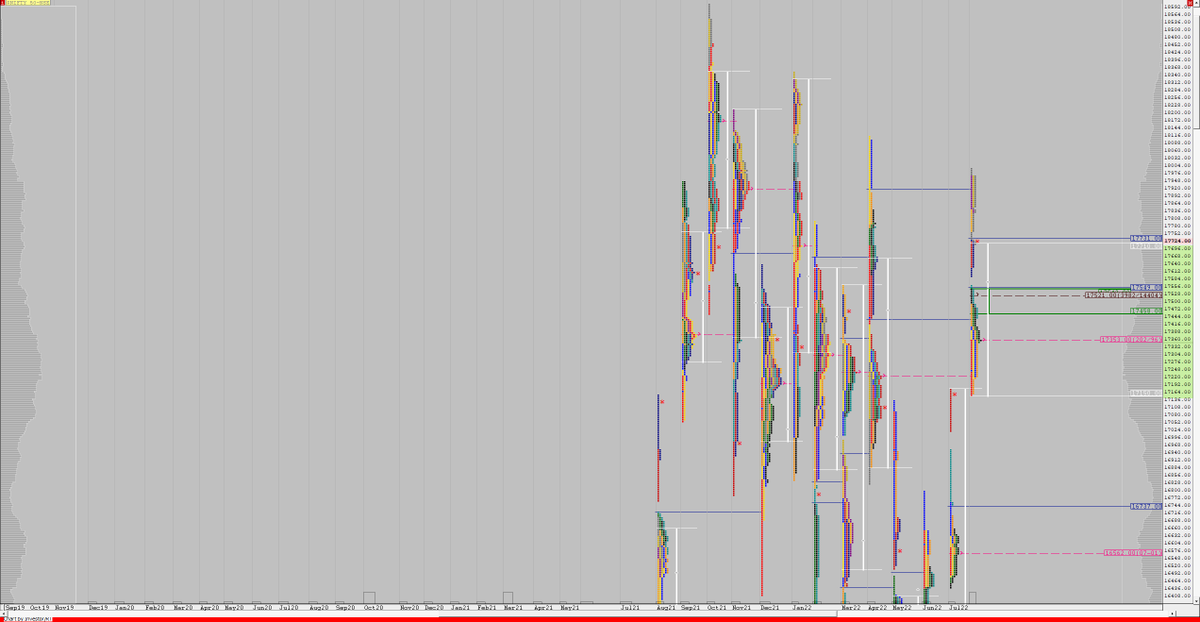

Major hurdle for call option on upside is near 600 levels. The overall pattern looks like distribution and break below 450 will suggest short term fall in option price. Nifty 15 mins 17k Call option – We are showing volume profile on the call option chart that suggest that important support is at 450 on the option price where there is significant volume followed by 370. We can see that even the next week expiry options are showing high buildup near 17500 calls so crossing this level is not going to be easy.Īlong with that we have channel resistance now near 1757 is the level where wave G will be 76.4% of wave A on a bigger time frame chart. At the same time the support at 17k had been not very significant as the change in OI was less. Nifty first chart shows Open Interest change on the expiry day which provided classic information that Nifty will not break above 17500 levels given sharp rise in call side OI. Nifty 15 mins 17k call option (Aug end expiry) Also in this entire up move majority has been trying to catch a top without any meaningful reversal to downside.īelow is Nifty 15 minutes chart with Open Interest and Nifty 17k month end call option It is important to understand that short term volatility can be seen due to events but the trend will not change unless the pattern is near completion. Changes carried out for (2) above are irrespective of changes, if any, carried out for (1) above.China Taiwan global tension resulted into lot of volatility in intraday on Nifty but markets continue to trade as Buy on dips without breaking crucial support levels. With respect to (2) above, a maximum of 10% of the index size (number of stocks in the index) may be changed in a calendar year.

the stock with the highest market capitalization in the replacement pool has at least twice the market capitalization of the index stock with the lowest market capitalization. When a better candidate is available in the replacement pool, which can replace the index stock i.e.

#Nifty chart free#

In such a scenario, the stock having largest market capitalization and satisfying other requirements related to liquidity, turnover and free float will be considered for inclusion. Compulsory changes like corporate actions, delisting etc. For this purpose, floating stock shall mean stocks which are not held by the promoters and associated entities (where identifiable) of such companies.Ī) A company which comes out with a IPO will be eligible for inclusion in the index, if it fulfills the normal eligiblity criteria for the index like impact cost, market capitalisation and floating stock, for a 3 month period instead of a 6 month period.Ī stock may be replaced from an index for the following reasons: This is the percentage mark up suffered while buying / selling the desired quantity of a security compared to its ideal price (best buy + best sell) / 2Ĭompanies eligible for inclusion in S&P CNX Nifty should have atleast 10% floating stock. Impact cost is cost of executing a transaction in a security in proportion to the weightage of its market capitalisation as against the index market capitalisation at any point of time.

Selection of the index set is based on the following criteria:įor inclusion in the index, the security should have traded at an average impact cost of 0.50% or less during the last six months for 90% of the observations for a basket size of Rs. The constituents and the criteria for the selection judge the effectiveness of the index.

0 kommentar(er)

0 kommentar(er)